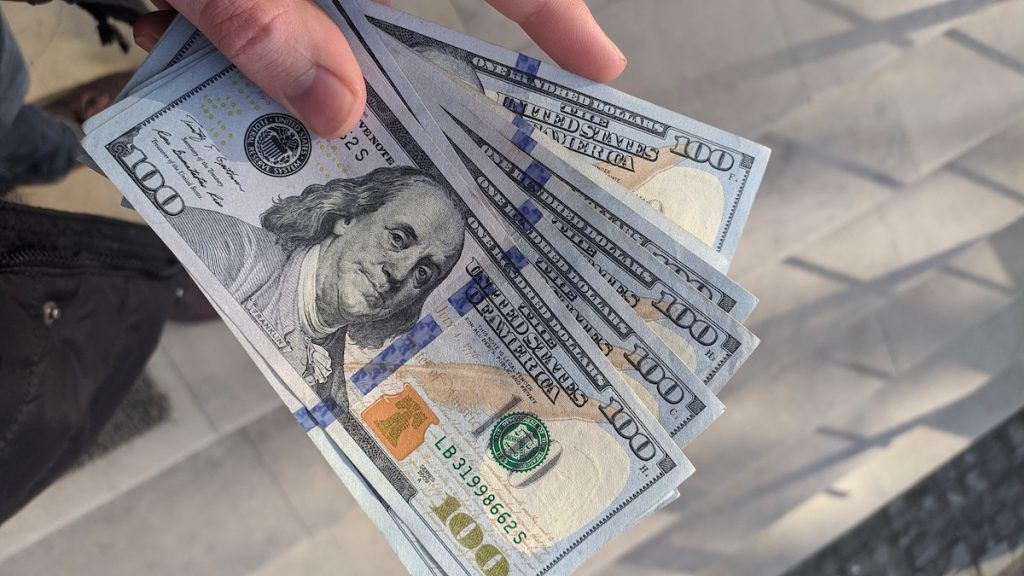

In today’s fast-paced world, unexpected financial emergencies can arise at any moment. Whether it’s a medical bill, car repair, or any other unforeseen expense, having quick access to funds can be a lifesaver. This is where 24 hour payday loans come into play, offering individuals a swift and convenient solution to tackle their financial crises. This article explores how 24-hour loans serve as a swift and convenient solution for individuals facing unexpected financial emergencies in today’s fast-paced world.

Understanding 24-Hour Loans

How Do They Work?

24-hour loans, also known as cash advance loans, are short-term lending options designed to provide borrowers with immediate access to a small amount of money. These loans are typically repaid on the borrower’s next payday, making them a short-term commitment. The process is straightforward and streamlined, allowing applicants to apply online or in-person and receive a decision within minutes.

The Speedy Application Process

One of the most attractive aspects of 24-hour loans is the speed at which they can be obtained. Traditional loans from banks often involve lengthy approval processes and extensive documentation. In contrast, payday loans require minimal paperwork, making them an ideal choice for those in urgent need of funds. The application process is user-friendly, and borrowers can complete it within a matter of minutes.

Benefits of 24-Hour Loans

Immediate Financial Relief

During financial emergencies, time is of the essence. 24-hour loans offer rapid access to funds, ensuring that borrowers can address their pressing needs promptly. This speed can prevent further financial strain or the accrual of additional costs due to delayed payments.

No Credit History Barrier

Traditional loans often require a strong credit history for approval. However, payday loan lenders focus more on the borrower’s income and ability to repay rather than their credit score. This inclusivity opens up borrowing opportunities for individuals who might face challenges with their credit history.

Flexibility and Convenience

Payday loans offer flexibility that suits the dynamic nature of financial emergencies. Borrowers can select loan amounts that match their needs and repay them on their next payday. This short-term commitment can be particularly beneficial for those who prefer not to carry long-term debt.

Payday Loan Lender Companies: Your Financial Partners

Professional Assistance When You Need It Most

In the realm of 24-hour loans, several lender companies stand out by offering reliable services tailored to individual needs. These companies understand the urgency of financial crises and work tirelessly to facilitate quick loan approvals and disbursements.

Guidance Through the Process

Reputable payday loan lender companies provide clear terms and conditions, ensuring that borrowers are well-informed before entering into any agreement. They guide borrowers through the application process, explaining the loan terms, repayment schedule, and any associated fees.

Transparent and Responsible Practices

Responsible lending is a cornerstone of trustworthy payday loan lender companies. They adhere to industry regulations and ethical practices to ensure borrowers are treated fairly. This includes disclosing all relevant information to borrowers and promoting transparency in fees and interest rates.

In times of financial emergencies, having access to quick funds can make all the difference. 24-hour payday loans offer a lifeline for individuals facing unexpected expenses, providing them with a swift solution to their financial woes. While these loans offer undeniable benefits, it’s crucial to approach them with careful consideration and responsible borrowing practices. By partnering with reputable payday loan lender companies, borrowers can navigate their financial emergencies with confidence and ease.